Frauds and dangers in ecommerce. How do professional anti-fraud systems take care of these?

In the wake of the global pandemic, after many businesses moved into the online space, e-commerce has truly boomed. But simultaneously, what also boomed is the amount of online fraud. Just in one year from 2019 to 2020 the number of frauds in the US has almost doubled, and worldwide the trend is very similar.

Obviously, it is discouraging for merchants to have to share their hard-earned income with cheaters. Fortunately, there are some ways to defend against these. The base of such defense should be anti-fraud systems and procedures, some of which are required by law. They usually come in a package with any payment hub. Let’s review some ways in which such systems help your e-store.

Database breaches in times of GDPR

Hackers are operating 24/7, looking for security gaps in the e-stores across the world. And customers are also aware of increasing risks related to their personal data. They know that sometimes by providing your credit card data to an e-shop directly, they might expose the wealth accumulated in their bank accounts to a dangerous third party. As a merchant, you are obliged by both payment organizations and GDPR regulations to prevent data leakage (sensitive card data, personal data, etc.) and if such a leak occurs, you are obliged to take corrective actions. Regulators or payment organizations can also impose financial penalties due to data leakage so if the inspectors find out that you haven’t done enough to protect the data, it might earn you a hefty fine as well.

Solution: It is a good idea to make sure that the systems you’re utilizing are providing extra data protection measures, i.e. payments hubs often take extra steps to secure the details of bank cards (with Payment Card Industry Security Standards (PCI)that is dedicated to protect card data and IT security tools), at the same time not requiring the e-shop to store such personal data. If you are unsure about the state of your shop’s current protections, you should request a security audit or hire a specialist which will be responsible for continuously responding to any potential dangers.

Stolen credit cards – a problem not only for customers but also businesses

The credit cards numbers are a priceless good for the hackers. Whether someone accidentally posted them in social media, got phished or leaked them in any other way – the cybercriminals won’t hesitate to take advantage of the obtained data. While it might seem like a customer-only issue, the businesses can actually get hurt badly by customers’ inability to protect their data.

A sudden rush of a smaller value transactions, or requests from customers for reimbursements due to accident a lover payments, or asking to redirect the shipment to another address – these events might seem innocent enough, but if you’re not protected by great fraud prevention tools and Anti-Money Laundering system, it might cause you a great deal of problems. A bad actor might test stolen cards numbers in your e-shop. If the protection system doesn’t detect it early enough, your business ends up with tons of purchases that were shipped away and hundreds or even thousands or chargebacks that need to be processed and paid for. And the original buyer is nowhere to be found.

Solution: Apart from keeping your e-store secure, you need to invest in a good software that will provide you fraud protection and compliance with Anti-Money Laundering requirements. Since all payment processors are required to protect the payment environment from frauds and to fall in line with Anti-Money Laundering law, a good base of your security defense should be a payment hub (such as ZEN.com), which has qualified specialists and systems in the place. The technologies based on AI or machine learning will quickly flag any suspicious transactions and the human investigators will review it and take further steps based on the gathered intelligence.

Friendly fraud not so friendly

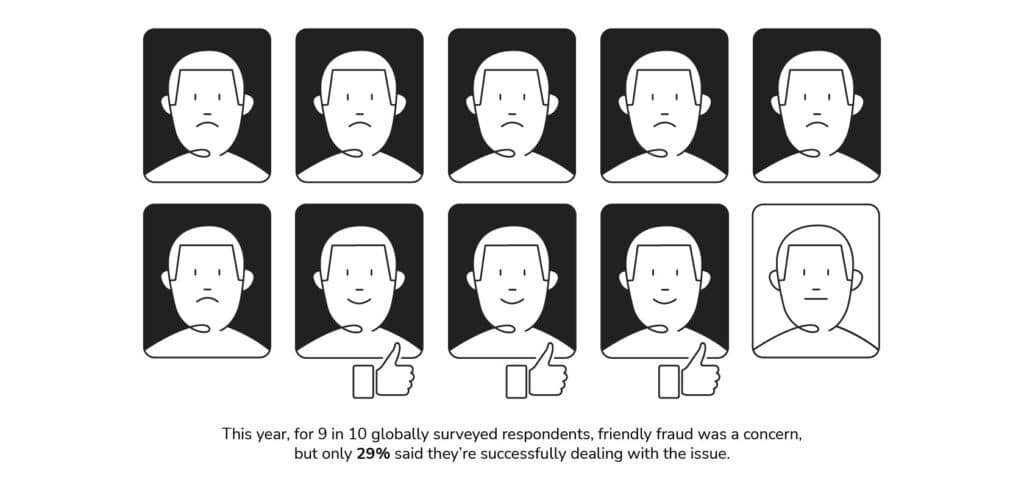

Chargebacks are the bane of the merchants’ existence. Sometimes it’s a mistake of the system (i.e. a double charge), but many sellers notice a rising number of so-called friendly frauds, which actually aren’t friendly at all. It happens when customer makes a purchase and tries to invalidate it on purpose, even though they have no reason to do so. The credit card companies and banks, upon receiving a chargeback form, are expected to investigate the case and if needed, to return the transaction’s value to the complaining client and demand its equivalent from you. This year, for 9 in 10 globally surveyed respondents, friendly fraud was a concern, but only 29% said they’re successfully dealing with the issue.

The main issue with such chargebacks is that they tend to be costly for the business. It’s not only about the sum of money you have to return, but also about other operational costs. Taking in account the transaction fees charged by payment processors for processing a given purchase, the expenses related to processing an order and shipping out the package, chargeback processing fee, as well as financial penalties from -card schemes – all of this might mean that with each chargeback you’re losing twice or thrice as much as the value of the original transaction.

Solution:Make sure that it is very clear that you intend to provide the highest quality of service to the customer. Record all your activities related to their order, i.e. packing, shipping, answering emails. Additionally, don’t be afraid to take advantage of payment hubs such as ZEN.com, which takes care of your chargebacks in a comprehensive manner. You can just delegate this task to us – we will sort out the issue and you won’t have to pay any money if you fall victim to friendly fraud or stolen credit cards number.

Sources:

Insurance InformationInstitute, Facts+ Statistics: Identity theft and cybercrime | III,2021

Chargebacks911, 2021 ChargebackField Report, 2021